A coupon bond or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from the issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a year divided by the face value of the bond in question).

What is a coupon bond or coupon payment?

Coupon bonds are a type of bond that pays fixed interest (coupons) at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date.

The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond’s nominal value and the period factor.

For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 10%, your annual interest payment will be $10.

Key Points:

- A coupon payment refers to the annual interest paid on a bond between its issue date and the date of maturity.

- The coupon rate is determined by adding the sum of all coupons paid per year, then dividing that total by the face value of the bond.

Related: Index Fund vs Mutual Fund

Coupon Bond Pricing

These bonds are relatively simple, but their price remains a key issue.

If you are investing in these bonds, then you should know the pricing well so that you can reap the maximum benefit it.

Knowing the pricing of these bonds tells them the maximum price that they will have to pay for the bond.

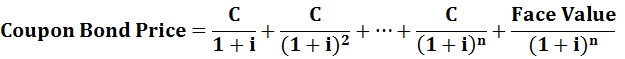

The investors may need a higher rate of return on the bond if the probability rate is high by default. There is a formula to determine the price of coupon bonds:

- c = coupon rate

- i = interest rate

- n = number of payments

Terms Related to Coupon Bonds

These bonds are also known as bearer bonds. This name is derived from the fact that anyone who presents the coupon to the issuer is entitled to the interest payment whether or not the person is the owner of the bond.

This feature of the coupon payment could lead to tax evasion and fraud.

Some coupon bonds are known as ‘zero-coupon bonds.’ These are bonds that do not make cash payments of interest through the duration of the bond but are instead issued as discounts to the maturity value of the bonds.

The specific discount value is calculated to provide a certain rate of return at maturity when the bond is set to be redeemed for its full face value.

Conclusion

The term “coupon” originally refers to actual detachable coupons affixed to bond certificates.

Bonds with coupons, known as coupon bonds or bearer bonds, are not registered, meaning that possession of them constitutes ownership.

To collect an interest payment, the investor has to present the physical coupon.

Bearer bonds were once common. While they still exist, they have fallen out of favor for two reasons.

First, an investor whose bond is lost, stolen, or damaged has functionally no recourse or hope of regaining their investment.

Second, the anonymity of bearer bonds has proven attractive to money launderers.

A 1982 U.S. law significantly curtailed the use of bearer bonds, and all Treasury-issued bearer bonds are now past maturity.

Today, the vast majority of investors and issuers alike prefer to keep electronic records on bond ownership.

Even so, the term “coupon” has survived to describe a bond’s nominal yield.

4 comments on “What is coupon bond or coupon payment?”